Last Updated on March 11, 2024 by admin

A borrower must check the CIBIL score to get a Personal Loan. CIBIL score helps to understand the creditworthiness of a borrower. When a borrower checks his/her CIBIL score, it is considered a soft inquiry. On the other hand, when a prospective lender asks for a CIBIL report, it is considered a hard inquiry. A borrower can check his/her CIBIL score numerous times to keep an eye on the CIBIL score. Checking CIBIL score frequently helps in better planning for a future loan. However, when a lender asks for a CIBIL report frequently, it negatively impacts your CIBIL score. As a borrower, you should avoid multiple loan applications in a short period of time as it makes a negative impact on your CIBIL report.

There are majorly four credit bureau agencies that provide you with a credit score and credit report – Equifax, TransUnion CIBIL, Experian, and CRIF Highmark. The Credit Information Bureau (India) Limited (CIBIL) is responsible for generating and preparing credit reports for individuals as well as for companies. CIBIL score is a three-digit number that defines the creditworthiness of a particular individual.

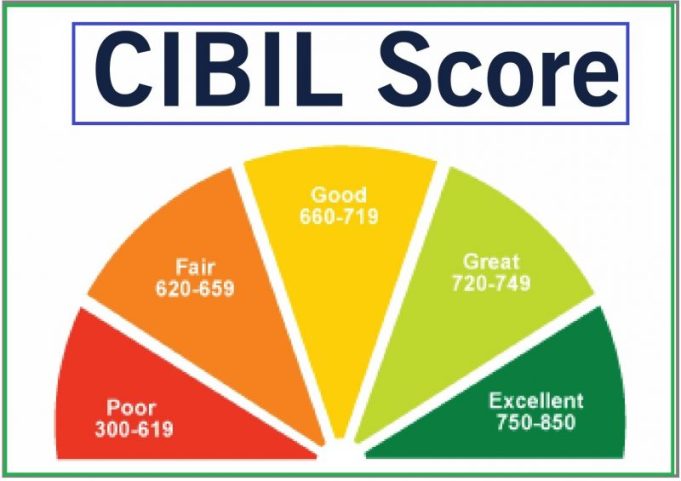

Please find the below table that provides an indicative range for creditworthiness and chances of loan approval for an individual based on their CIBIL score.

| CIBIL Score between | Creditworthiness | Chances of Loan Approval |

| 750 and 900 | Excellent | Very High |

| 700 and 749 | Good | High |

| 650 and 699 | Average | Possible |

| 550 and below | Bad | Low |

| 550 and 649 | Poor | Difficult |

- CIBIL score between 750-900 – A borrower with a CIBIL score between 750-900 is considered creditworthy and has a higher chance of getting loan approval. This score also indicates that a borrower has made all the repayments on time without any default. Maintaining such a score requires discipline and considerable planning. A borrower with a 750 and above CIBIL score will get a higher loan amount with a lower rate of interest and several other benefits such as minimal documentation, quick approval, and disbursal.

- CIBIL score between 700 -749– A CIBIL score between 700-749 is considered a good credit score. However, there is room for improvement and a further increase in the CIBIL score. There is a slight hesitancy from a lender when it comes to a borrower with a CIBIL score between 700-749. A slight improvement in the CIBIL score will allow the borrower to opt for a loan with a lower interest rate.

- CIBIL score between 650-699 – A CIBIL score between 650-699 is considered an average CIBIL score which is neither good nor bad. To increase the chances of getting a higher loan amount with a lower rate of interest, a borrower must try to improve his/her CIBIL score. It is advised that a borrower must repay on time to reduce the chances of loan rejection. A lender will avail a loan to a borrower with a CIBIL score between 650-699 but with a higher rate of interest.

- CIBIL scores between 550-649 – A CIBIL score between 550-649 indicates that a borrower has delayed his previous repayments or is inconsistent with his repayments. Such borrowers are considered highly risky as they have lower creditworthiness. Borrowers with CIBIL scores between 550-649 will have to provide a guarantee considering the high risk of repayment. As a borrower, you must repay all the existing loans before planning to apply for a new loan.

- CIBIL scores 550 -below – A CIBIL score between 550 and below is considered a bad CIBIL score. A lender will consider you as a high-risk borrower. As compared to a borrower with a high CIBIL score, your chances of getting a loan are relatively low especially if you are looking for a higher loan amount. The lender will avail your loan at a higher rate of interest against collaterals such as your personal assets, fixed deposits, shares, etc.

How to check the CIBIL score online?

By following the below steps, you can check your CIBIL score easily:

Step 1. Go through the official website of CIBIL

Step 2. Add all the details such as your name, PAN card number, address, phone number etc.

Step 3. Confirm all the details after providing all the necessary information

Step 4. You will receive OTP on your registered mobile number

Step 5: By inserting the received OTP You can check your credit score at myscore.cibil.com